What we have is normal and ABNORMAL. We have had both for awhile.

Let’s review.

Bond yields are back to normal levels after many years of far below normal rates that began in 2009.

What started out as an enormous financial experiment in new Federal Reserve policy – buying huge amounts of Treasury securities issued to finance unprecedented amounts of new federal debt and pushing interest rates down to nearly zero on short maturities and only 2% on long bonds, was at first seemingly very successful. Geniuses, we were.

So, back then we got the economy on the right track by being abnormal. In other words, back to normal by being abnormal. That was part 1 – back to a normally growing economy.

We knew that eventually we needed to go back to normal interest rates of 5% and 6% but we didn’t want to. Life was too good with 3% mortgages and a 2% average rate on Treasury debt.

Enter a new abnormal – the COVID virus, a locked-down economy, and in its aftermath, 9% inflation. The only cure was to raise interest rates again. So, they did. Problem solved. Geniuses. That was part 2 – a return to normal interest rates.

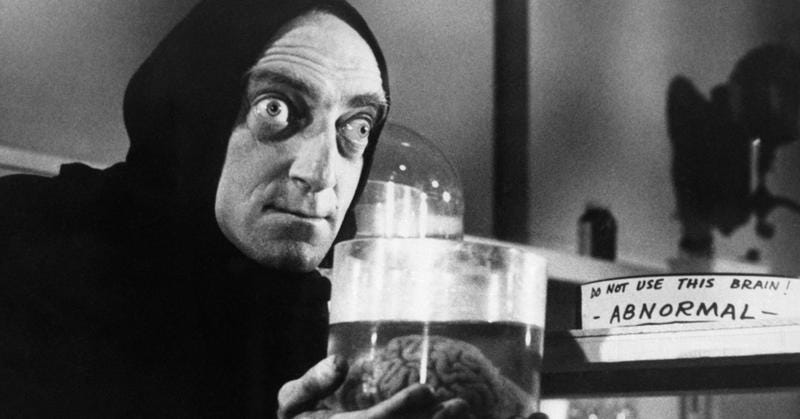

We thought we were working with a genius brain. But, when our patient finally woke, it seems that what we actually have is not the brain of Hans Delbruck, brilliant scientist, but the brain of ABNORMAL, if you remember the movie Young Frankenstein. And so now we have a monster to deal with.

We have three, even four problems – a mountain of federal debt, rising interest costs as that debt is refinanced (most of it was short maturities), politicians grown accustomed to spending far in excess of federal tax revenue, and only a few interested in stopping them, cast by the media as annoying roadblocks.

The bond market’s response over the last 12 months was to demand higher yields on the longer bonds that had stayed stuck at 2% while short rates were at 5%. How do you get a 2.5% long term Treasury bond to yield 5%? Easy, you cut its price in half. And that’s what happened, the worst 12 months for bonds ever.

The stock market had a rough 2022 but rebounded in 2023. That is, until September, when the Dow Jones Industrial Average lost all its gains for the year. More stocks are now down than up this year.

Now what?

Prediction #1 – the Fed is going to keep short-term interest rates at current levels well into next year and may even raise rates a bit in December this year.

Prediction #2 – long-term interest rates will stay about where they are as well.

Prediction #3 – the stock market will have more difficulty this month as it comes to terms with that and with the dysfunction in Washington, with another shutdown deadline in November, few who want to control federal spending, and two very unpopular presidential candidates with no real competition.

Strategy – I pulled a good bit of money out of stocks in September and am keeping an eye on things as to when to put that back. I continue to have very little in bond funds and a lot in cash paying about 5.25%. Defense is the name of the game at present.

However, I think the stock market’s troubles are short-term. I don’t foresee a large or long decline in stocks. The economy is still humming along, inflation is not much above the Fed’s target and unless the Fed gets aggressive about raising rates again, which I doubt, bonds should stay about where they are on both short and long maturities.

Because of that, I don’t plan to stay light in stocks for very long. But, there are worse things than earning 5.25% in cash.