It’s Time to Travel Overseas

My wife and I used to do a lot of overseas travel and we passed that bug along to our youngest daughter, but in the last few years we’ve done trips in the U.S. The same could be said for my investment allocations. I have not had an allocation to overseas stocks since 2008 and for good reason, international stocks have just been punk for the last 15 years as I’ll show you in a moment. If you’ve been allocated to international markets, and many target date and balanced funds keep sizable allocations overseas, they have been a terrible drag on investment performance ever since the Great Recession in 2008-2009. But, hey, trends don’t last forever. Now, it’s time to travel overseas.

My wife and I used to do a lot of overseas travel and we passed that bug along to our youngest daughter, but in the last few years we’ve done trips in the U.S. The same could be said for my investment allocations. I have not had an allocation to overseas stocks since 2008 and for good reason, international stocks have just been punk for the last 15 years as I’ll show you in a moment. If you’ve been allocated to international markets, and many target date and balanced funds keep sizable allocations overseas, they have been a terrible drag on investment performance ever since the Great Recession in 2008-2009. But, hey, trends don’t last forever. Now, it’s time to travel overseas.

International Markets Have Not Been Good for a Long Time

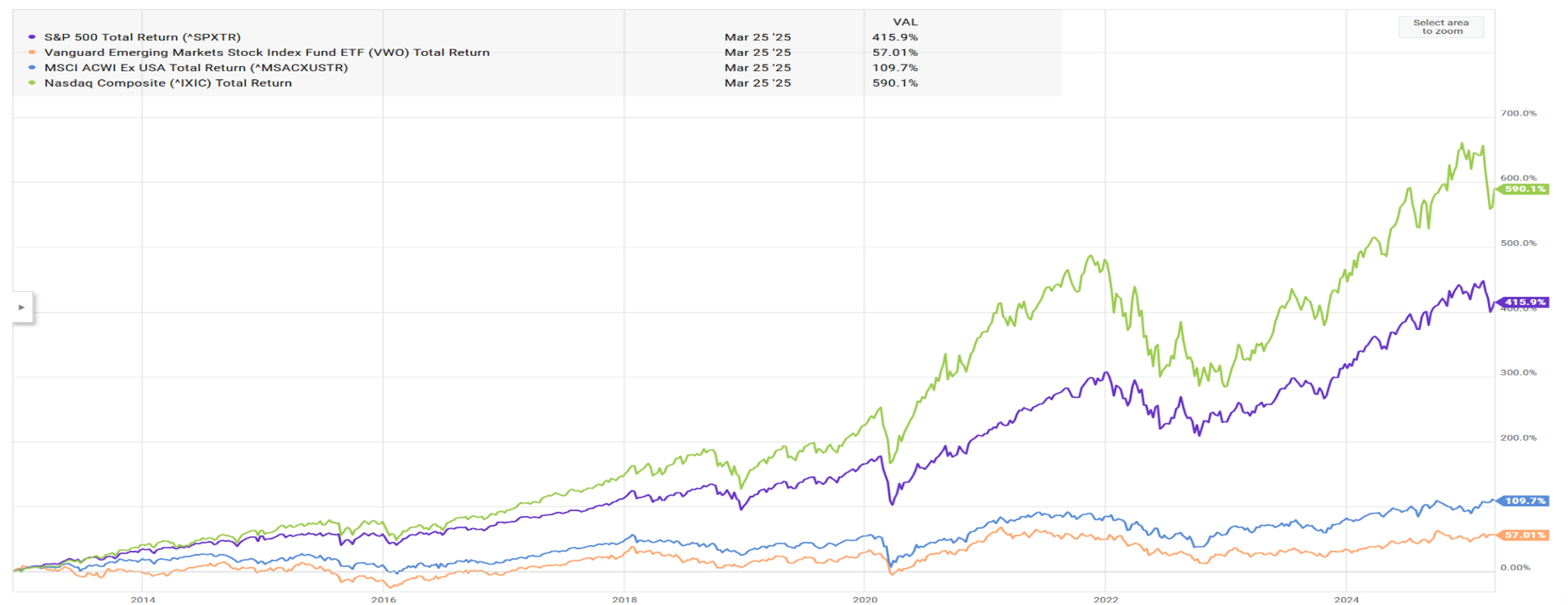

Look at the chart below showing U.S. large cap growth stocks as represented by the green NASDAQ Composite Index, U.S. large cap stocks in general shown by the purple S&P 500 major stock index and compare them to international stocks and emerging market international stocks as shown by the bottom two lines. This is why I have not been invested in international stocks for the last 15 years.

According to the Wall St. Journal, “An index of non-U.S. developed-market stocks tracked by MSCI (the MSCI EAFE Index) fetches less than two-thirds the P/E (price to earnings ratio) and barely one-third

According to another study quoted in the Wall St. Journal, only 2% of the time have international stocks been this cheap compared to the average U.S. stock.

Check out the table below showing the P/E (price to earnings ratio) for selected countries. The U.S. market average is nearly 26 while the most expensive European country is 18.6. The most expensive Latin American country is Brazil at 10.7 and China is even cheaper at less than 10.

Such extremes in valuation always come back to normal. You can’t know when, but you can know that to close that gap, either U.S. stocks, especially large growth stocks, must fall in price or international stocks must rise in price, or both.

Even if you can’t know the when, you can know that this situation makes the risk in U.S. large growth stocks much higher than normal and the risk in international stocks much lower than normal. And you can bet that stock prices will adjust to close that gap.

Don’t Just Travel Anywhere

There are a couple risks with investing overseas. First, there is currency risk because foreign stocks are traded in foreign currency and that has to be translated back to U.S. dollars for us. If the dollar gets more expensive, you get fewer dollars when you convert foreign currencies to dollars and that hurts returns.

The second risk is political risk. Because China has said they are going to take over Taiwan and has been running very large-scale practice runs the last couple years of blockading Taiwan. Taiwan has not much for a military in comparison and the U.S. does have the naval capability or missiles to stop a takeover of Taiwan. War games simulating such an attack have been run and the battle has been quickly over. That’s a big problem because China and Taiwan together make up 50% of the MSCI Emerging Market Index. So, if you are going to add emerging market exposure you need to look hard for a good fund that has a low or minimal weighting to those countries and that’s hard to find. I have found a good fund I like but it took some research.

Europe Show More Promise

Europe, which makes up most of the MSCI EAFE international stock index is a much better bet for a number of reasons. First, they are relatively much cheaper than the U.S. Second, they are waking up to the idea that they have been too bureaucratic, too extreme in anti-growth environmental policies that have made electricity terribly expensive and new manufacturing plants too hard to get approved and been too lax on immigration that has raised the already expensive cost of government.

the idea that they have been too bureaucratic, too extreme in anti-growth environmental policies that have made electricity terribly expensive and new manufacturing plants too hard to get approved and been too lax on immigration that has raised the already expensive cost of government.

And, as the Trump Administration has repeatedly communicated that they need to take more responsibility for their own defense rather than relying on the U.S., several countries have realized that they need to dramatically increase spending on defense which is a boost to their economies. Finally, they are in a much position to lower interest rates, boosting economic growth. All that bodes well for their economy and in turn, their stock markets.

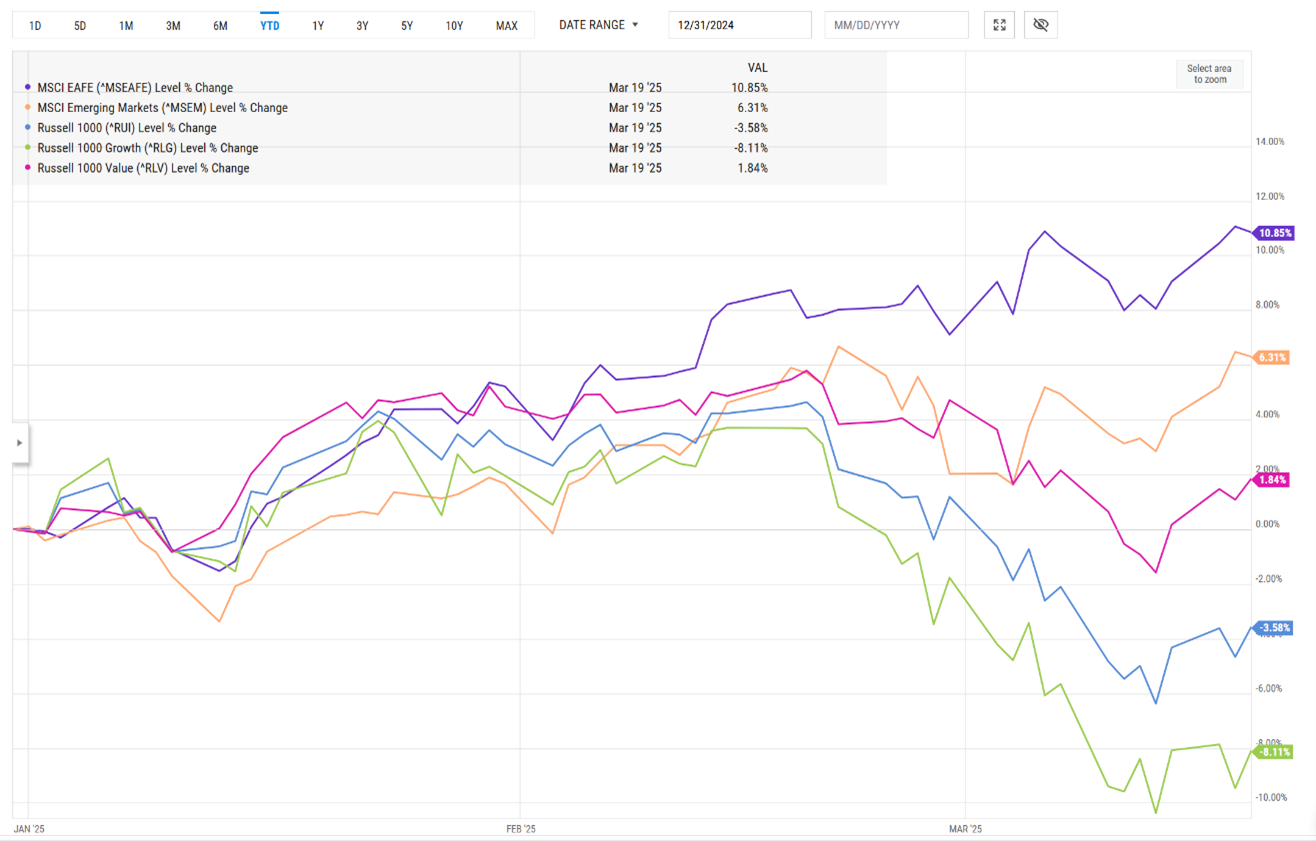

So far this year, the trend has been for U.S. growth stocks to fall and for international stocks to rise rapidly. If you look at the chart below you can see that the MSCI EAFE index of international stocks is up nearly 11% so far in 2025, emerging markets up 6% and the Russell 1000 Growth Index of the top U.S. growth stocks has fallen 8%. The better U.S. option has been value stocks, not growth stocks, but international has beaten handily so far in 2025.

Bottom line – there is less risk and more potential reward than normal in international stocks while there is more risk and more potential loss than normal in U.S. large growth stocks. Investing overseas should be done mainly with funds that hedge against a rise in the U.S. dollar and any emerging market exposure should seek to avoid China and Taiwan.