Trouble in Paradise

At the beginning of the year, they stock market was off to a good start, unemployment was low, a new president was in office trying to reduce government waste and overregulation, and the Federal Reserve was lowering interest rates. We saw the economy, and behold, it was good. A few were preparing for trouble in paradise, but not many.

Trade War

Two months after taking office, President Donald Trump initiated what has quickly become a trade war on a scale

It started soon after taking office as he announced tariffs against Mexico and Canada. Many people assumed he was just using them as bargaining leverage in trying to stem the flow of illegal drugs and illegal border crossers.

That turned out not to be the case. The president has said he believes that higher tariffs are needed to bring manufacturing back to the United States, lessen the nation’s trade deficit, and counteract high tariffs from some other countries. So, in a shocking move, in one day he announced tariffs against 185 countries, 10% at a minimum plus quite a bit more in many places. Previously, the average tariff on Europe for example was 2.5%.

Since then 60 countries have said they want to negotiate tariffs and we’ll have to see how that plays out. There are conflicting stories even in the White House. Donald loves a deal, but the stock market was pummeled and most economists were not pleased. Not a few investors found themselves in panic mode, others are angry, and given that constitutionally trade authority except in times of real crisis belongs to Congress, people are wondering if this is going to the Supreme Court.

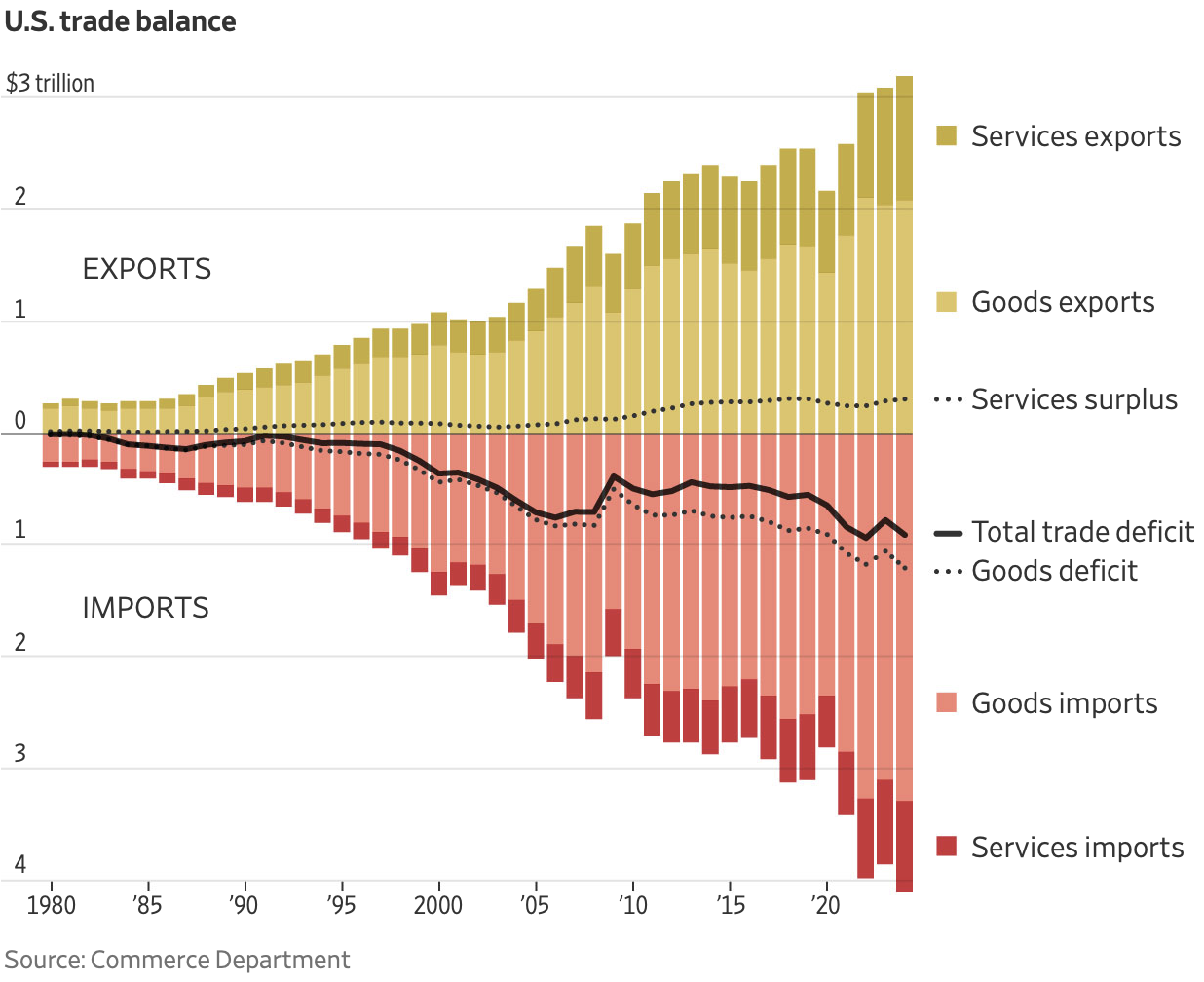

Trade Deficits

Look at our unemployment rates. At roughly 4%, unemployment is about as low as unemployment can get. You can’t get zero unemployment because there are always jobs where they can’t find enough skilled workers.

Just because we are not exporting services like accounting, or engineering, or cutting hair, does not mean we aren’t making money from those services. We just consume them here. We have a lot of money and we buy more than we sell. Higher incomes, lower prices, what could be wrong with that?

The Remedy

Two Problems

The second problem is this. What will these companies do when it costs them a new tariff tax of 20-30% to import these goods? They will raise prices, of course, probably 20-30%.

Next, what will their competitors who don’t import, if there are any, do when those prices go up 20-30%? They will likely use the cover to raise their prices some too. The result is likely to be the worst inflation since the Arab oil embargo in the mid-1970s when gasoline went from 20 cents a gallon to over a dollar.

There is the strong possibility that people will see inflation like most have not seen in their lifetimes. Since we import 50-75% of our produce, especially during the cooler half of the year, you could see produce prices go up 20-30% in a year. Car prices are projected to go up at $10,000 – $15,000.

The Retaliation Problem

T

Add that to the issue of confusion as corporate America wonders what announcement or about-face is coming next, and whether they want to start building factories when as in the administration that followed Pres. McKinley, tariffs are reversed. They might also recall that there were bad recessions that followed the McKinley tariffs.

Recession is a likely outcome again because of increased costs for some companies, because of reduced exports and reduced business for other companies, and because of the likelihood of consumers pulling back as prices go up sharply and some workers get laid off.

Stock Market

Do you see now why the stock market is down 15% – 20% and going lower again today? We are looking at not only a possible recession but much higher prices. If prices go higher, the Fed will have to choose between stimulating the economy with lower rates and having to raise rates to combat inflation. It would appear that the only short-term winners in all this are companies who don’t need to import goods and the government that collect the tariffs.

Strategy

In the last couple days, I have sold many of our stock funds and replaced them with others that have tended to fall less in market downturns, usually because they have heavy weightings in industries like utilities and healthcare and products people buy no matter what.

I am also buying gold or funds that invest in gold mining companies that typically go up with higher inflation. Gold has pulled back some from a very strong first quarter and given us an opportunity. Gold prices are very sensitive to increased risk of inflation.

How Far Could the Market Fall?

I would say the market would likely not fall more than it did in 2008-2009, which was 50%. The market as of today is down 12-20%, depending on the index, and if goes like last week, we could be halfway to a bottom shortly. On the other hand, there was some talk that the president might entertain a 90-day pause in tariffs and that 50 countries had lined up to talk about lowering their tariffs on U.S. goods. If progress is made on either, that would help the market considerably.

Bottom Line

We will get through this. If you have questions, by all means, please call me.