Evaluating a Financial Professional – Red Flags

When evaluating a financial professional such as those working for brokerage firms, financial planning firms, insurance companies, or independent advisory firms, how do you know if a financial pro is any good? Are there some red flags you should watch for? Yes.

Red flag #1 – They have a regulatory record with issues.

The first thing you should do to evaluate a financial professional is to check their record and their employer’s record on Brokercheck. This is a site maintained by FINRA, a government agency

Red flag # 2 – They receive commissions as part or all of their compensation

Commissions are not inherently bad, but they are easy to abuse, especially if the advisor holds themselves out as fee-based rather than fee-only. In that case, they may charge both fees and commissions. Make sure they clarify that. You don’t want someone calling with a recommendation because they are looking to “make their month.” Especially be alert for commissions on life insurance or annuities. More on this later.

Red flag # 3 – They are unwilling to put in writing that they are acting as a fiduciary

Many brokerage firms, banks, and insurance companies hesitate to let their employees put in writing that they are fiduciaries, i.e. a professional that must by law act in the best of the client. Many of these firms fought vociferously against such a requirement becoming law and did so somewhat successfully in many instances.

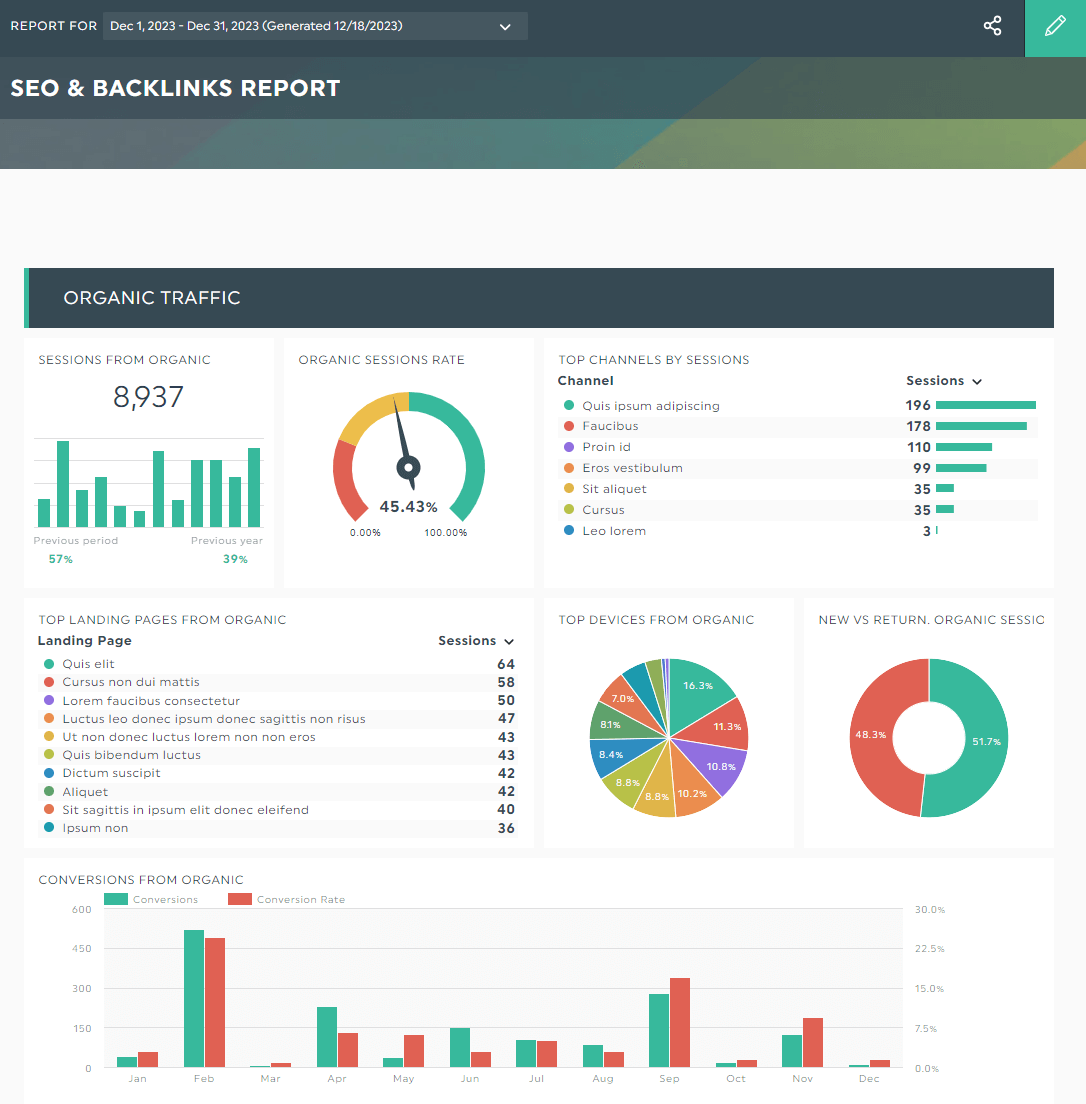

Red flag #4 – They do not provide you with performance reports and performance benchmarks when asked

Every investor ought to have measurable goals. But the first thing I learned when I was a young advisor was that while the firm tracked commissions by the hour, they did not track investor

How then can an investor know if their advisor is any good? They can’t, and that’s a big, big problem.

Red flag # 5 – They recommend insurance as investment products for growth

I believe that people should protect their families with life insurance. I also believe that insurance can have a place in estate planning. But insurance as an investment product? No, no, 100 times no!

According to Nerd Wallet, “Commission structures vary by policy and company. But typically, life insurance agents receive as commission 60% to 80% of the premiums you pay in the first year. They collect smaller commissions in subsequent years. Added up, 5% to 10% of all the premiums you pay over the life of the policy could go to commissions.”

I have seen commissions as high as 120% of the first-year premium. Do you really think you can earn a good return with 5% to 10% of all the money you deposit going to commissions?

I recently took on clients that each had an annuity for 13 years invested in stocks and bond choices within the annuity. They had made no money in 13 years and still had 4% in surrender charges if they wanted out. That’s criminal, but actually not illegal. It should be.

Another insurance sales pitch is to say that “IRAs are expensive.” What they mean is that you generally must pay income taxes when you withdraw the money after retirement unless it is a Roth IRA. Then they pitch life insurance as a nontaxable way to fund retirement because you are going to borrow out the policy value and not incur any taxes.

You should run from such an offer. Under current law, you don’t pay taxes, but you do pay interest to the policy and if your growth has been significantly hampered by commissions, caps on returns, and internal fees of various types, including the mandatory premiums to fund the life insurance, you are very likely to be worse off than if you had invested in good mutual funds. But not the person who sold you the policy. Depending on the size of the premiums, they may be making tens of thousands in commissions, even $100,000 or more. If you are in such a policy, bring it to me and let me have a salaried life insurance professional dissect it. It could turn out to be the best thing a financial pro ever did for you.

Ideally, what you should look for is an experienced, independent financial professional with a perfectly clear regulatory record, that works as a fee-only financial fiduciary (in writing), sets measurable goals and benchmarks with you, reports on them, and of course does not sell life insurance. Then interview them to see how you get along and how they would work with you to achieve your goals within your risk tolerance, time frame, and other considerations.