Insights

Investing in a Presidential Election Year

This year promises to provide plenty of election coverage and heartburn. But past election years have tended to provide average returns, and apart from the two major financial shocks in 2000 and 2008, since WWII election years have not been down years for stocks.

Looking Ahead – War with China on the Horizon?

I am very concerned that in the near future China with forcibly take over Taiwan and the U.S. may go to war with China. If so, the U.S. is not ready.

Artificial Intelligence Primer

What is artificial intelligence? Basically, we have learned to teach computers to think, to learn, to plan, to converse, to create, and integrate these skills, the hallmarks of intelligence.

TINA is Dead (How Bad It Is, How Bad It’s Not)

TINA (There Is No Alternative to stocks) is dead. That’s a good thing. However, there is a lot of angst among investors about both stocks and bonds, so let’s look at how bad it is and how bad it’s not.

Normal and ABNORMAL

What we have is normal and ABNORMAL. We have had both for awhile.

Has 2023 Been a Good Year for Stocks?

Has 2023 Been a Good Year for Stocks? How can you tell?

Well, let’s set 10% as a threshold since that is the long-term average return for stocks. Let’s annualize the returns so far, 10 days from having the first nine months on record and see how we fare.

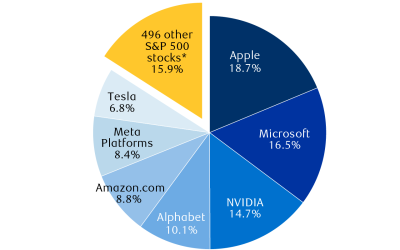

So Long S&P 500 Index

For decades, professional money managers have used benchmarks for measuring performance. For stocks, the standard index has been the Standard & Poors 500 Index (S&P 500). However, this index has become so extremely concentrated that it is no longer...

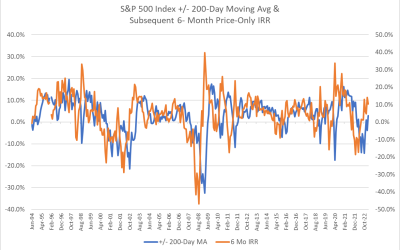

Are Extremes in Price Above the 200-Day Moving Average a Good Market Timing Tool?

Are extremes in price a good market timing sell signal to avoid large stock market losses?

Grading my Market Forecast for 2023 Made in Nov. 2022

Recently I sent out a client newsletter which pulled prior posts from my new website and which ended up including my market forecast for 2023 made in November 2022. That was a surprise to me, but it provided an opportunity to see how I did in forecasting the market...

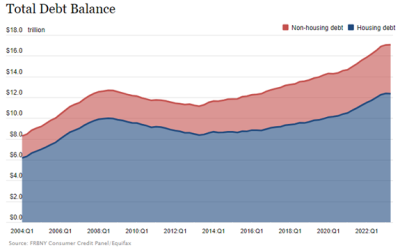

Household Debt

Household debt keeps employees from contributing to their retirement.

Questions?

Follow us!