Insights

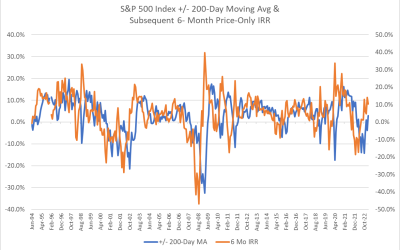

Are Extremes in Price Above the 200-Day Moving Average a Good Market Timing Tool?

Are extremes in price a good market timing sell signal to avoid large stock market losses?

Grading my Market Forecast for 2023 Made in Nov. 2022

Recently I sent out a client newsletter which pulled prior posts from my new website and which ended up including my market forecast for 2023 made in November 2022. That was a surprise to me, but it provided an opportunity to see how I did in forecasting the market...

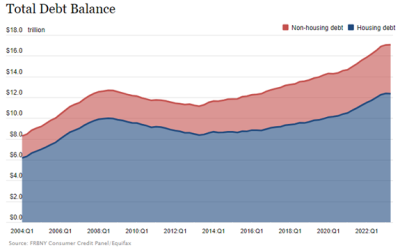

Household Debt

Household debt keeps employees from contributing to their retirement.

Personal Inflation Tracker

If you have access to the Wall St. Journal, IMO the best newspaper there is, they have a terrific inflation tracker that breaks down price increases to a very detailed level. You can create your own basket of items you use most to see your personal inflation rate....

Strategy Update – Nov 2022

Important Strategy UpdateWe have been completely out of stocks and bonds for about half a year and it has served us very well in protecting principal which I view as my primary responsibility. InflationInflation is still out of control, running over 8%, and while the...

The Fed Wanted More Inflation – They Got It!

Starting in the 2000s the Fed was worried about deflation and started on its course of very extended super-low interest rates in an effort to boost inflation to at least 2%. I said for years that 0% interest outside of a financial crisis and continued massive...

Is the Stock Market Undervalued After Falling 25% This Year?

The top chart shows the price to earnings ratio of the S&P 500 Stock Market Index. We are now only down to the top end of the long term range. The ratio is not perfect. It can spike when earnings go down a lot as it did in 2003, 2009, and 2020 so you have to...

Retirement as a Life Goal

Over my nearly 40-year career I have advised a lot of people on retirement planning. Here some key thoughts - A life goal of no longer being productive but just playing or piddling every day is not consistent with the way God wired men. Adam was put in the...

INVESTMENT STRATEGY NOTES

We are almost completely out of stocks right now because the trend in the market is sharply lower and I think it could continue to drop quite a bit.

Is Stagflation Back?

It’s BAACKK!! Talking about inflation. Here are the last 12 months of inflation data per the US Bureau of Labor Statistics. We have not seen 5% inflation since the 1980s but here it is again. Why? Take your pick. Shortages due to the economic shutdown and pernicious...

Questions?

Follow us!